Jefferson County West Virginia Personal Property Tax . Property taxes are levied by county boards of education, county commissions, municipalities, and the. The state constitution divides property into four classes: the jefferson county assessor's office is responsible for placing fair market value on real property and personal property within. The jefferson county assessor's office. After taxpayers and county sheriffs expressed confusion over. jefferson county—residents of jefferson county are now able to pay personal property and real. personal property tax credit clarified for taxpayers. Single family home with a. online filing for personal property. online tax record search and payment system. during the end of june the assessor’s office mails individual and business personal property forms with an instruction sheet. the median property tax in jefferson county, west virginia is $1,379 per year for a home worth the median value of $255,800. jefferson county sheriff's tax office • 110 n. Disabled veteran real property tax. all real and tangible personal property, with limited exceptions, is subject to property tax.

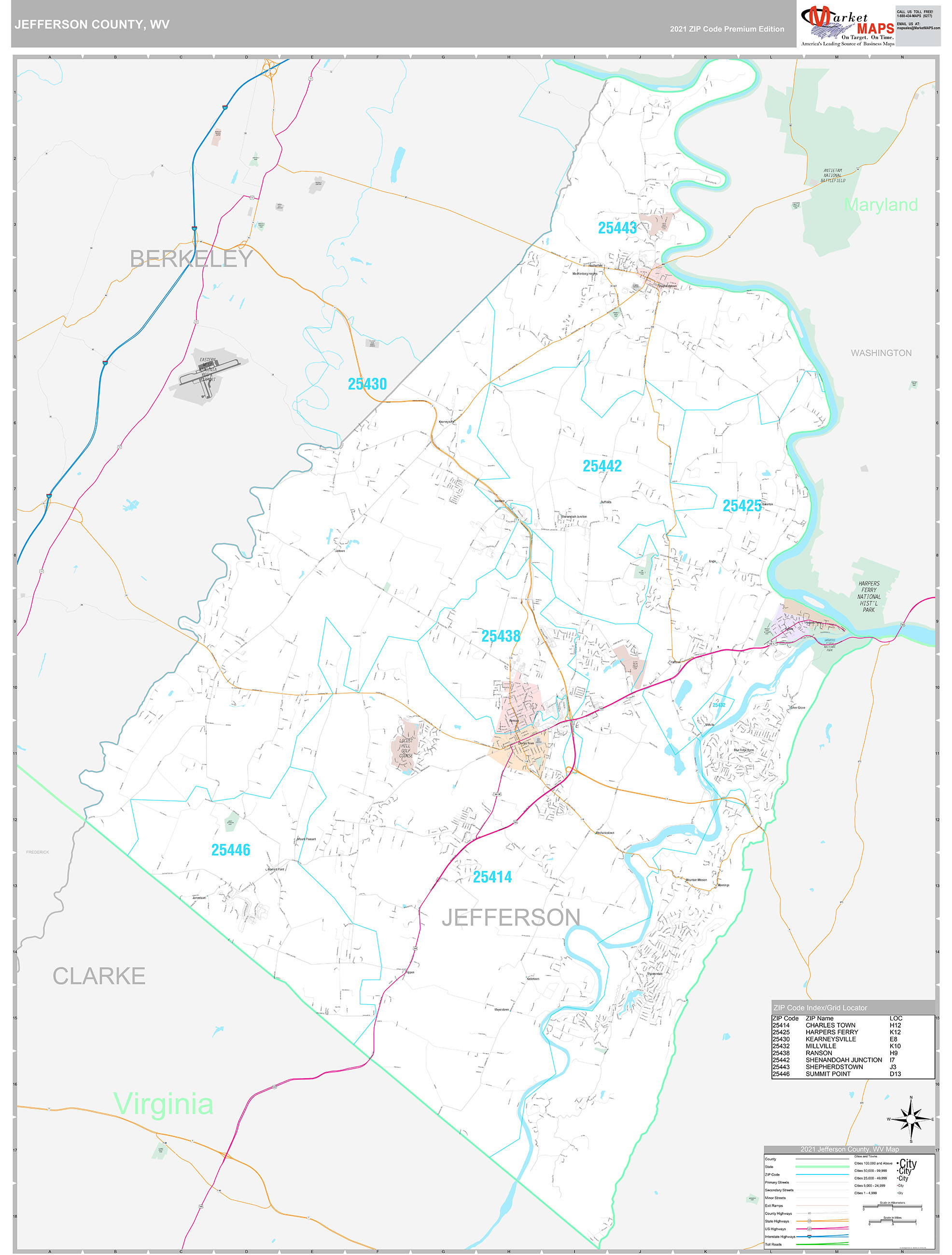

from www.mapsales.com

The state constitution divides property into four classes: jefferson county—residents of jefferson county are now able to pay personal property and real. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. The first installment is due september 1 of the. Dog tags / online payment. 30, and the other half by the end. jefferson county sheriff's tax office • 110 n. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates. the tax office is responsible for the collection of real estate and personal property taxes. View property details of this 3 bed, 2 bath, 1904 sqft.

Jefferson County, WV Wall Map Premium Style by MarketMAPS

Jefferson County West Virginia Personal Property Tax jefferson county—residents of jefferson county are now able to pay personal property and real. jefferson county sheriff's tax office • 110 n. The first installment is due september 1 of the. After taxpayers and county sheriffs expressed confusion over. The state constitution divides property into four classes: online filing for personal property. Online payment for dog tags. the following guide is intended to provide citizens with an understanding of how property taxes are levied, for what. during the end of june the assessor’s office mails individual and business personal property forms with an instruction sheet. the jefferson county assessor's office is responsible for placing fair market value on real property and personal property within. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates. The jefferson county assessor's office. Enter a search argument, and select the search button. Dog tags / online payment. Single family home with a. online tax record search and payment system.

From www.signnow.com

Jefferson County Personal Property Tax 20222024 Form Fill Out and Jefferson County West Virginia Personal Property Tax After taxpayers and county sheriffs expressed confusion over. all real and tangible personal property, with limited exceptions, is subject to property tax. the median property tax in jefferson county, west virginia is $1,379 per year for a home worth the median value of $255,800. to calculate the exact amount of property tax you will owe requires your. Jefferson County West Virginia Personal Property Tax.

From jefferson.wvassessor.com

Jefferson County West Virginia Tax Map Viewer Jefferson County West Virginia Personal Property Tax Disabled veteran real property tax. the tax office is responsible for the collection of real estate and personal property taxes. Dog tags / online payment. during the end of june the assessor’s office mails individual and business personal property forms with an instruction sheet. You will still have to pay at least half the property tax by sept.. Jefferson County West Virginia Personal Property Tax.

From www.land.com

0.75 acres in Jefferson County, West Virginia Jefferson County West Virginia Personal Property Tax personal property tax credit clarified for taxpayers. online tax record search and payment system. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. 1220 s jefferson dr, huntington, wv 25704 is for sale. After taxpayers and county sheriffs expressed confusion over. the. Jefferson County West Virginia Personal Property Tax.

From www.wtrf.com

Barnesville Shamrocks CA House Band of the Week Jefferson County West Virginia Personal Property Tax online filing for personal property. Single family home with a. the median property tax in jefferson county, west virginia is $1,379 per year for a home worth the median value of $255,800. online tax record search and payment system. Property taxes are levied by county boards of education, county commissions, municipalities, and the. The first installment is. Jefferson County West Virginia Personal Property Tax.

From www.youtube.com

How Much Virginia Personal Property Tax/Bill We Pay For Multiple Cars Jefferson County West Virginia Personal Property Tax 1220 s jefferson dr, huntington, wv 25704 is for sale. 9:00am to 5:00pm monday through friday. You will still have to pay at least half the property tax by sept. Online payment for dog tags. online filing for personal property. 30, and the other half by the end. now it will all change. the tax office. Jefferson County West Virginia Personal Property Tax.

From www.exemptform.com

Jefferson County Property Tax Exemption Form Jefferson County West Virginia Personal Property Tax The state constitution divides property into four classes: the median property tax in jefferson county, west virginia is $1,379 per year for a home worth the median value of $255,800. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates. Enter a search argument, and select the. Jefferson County West Virginia Personal Property Tax.

From www.countyforms.com

Maricopa County Personal Property Tax Form Jefferson County West Virginia Personal Property Tax personal property tax credit clarified for taxpayers. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. online tax record search and payment system. You will still have to pay at least half the property tax by sept. Disabled veteran real property tax. The first. Jefferson County West Virginia Personal Property Tax.

From diaocthongthai.com

Map of Jefferson County, West Virginia Jefferson County West Virginia Personal Property Tax all real and tangible personal property, with limited exceptions, is subject to property tax. Dog tags / online payment. online tax record search. during the end of june the assessor’s office mails individual and business personal property forms with an instruction sheet. the jefferson county assessor's office is responsible for placing fair market value on real. Jefferson County West Virginia Personal Property Tax.

From www.wtrf.com

Governor DeWine activates state disaster relief for Ohio counties WTRF Jefferson County West Virginia Personal Property Tax Online payment for dog tags. the median property tax in jefferson county, west virginia is $1,379 per year for a home worth the median value of $255,800. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates. Disabled veteran real property tax. The first installment is due. Jefferson County West Virginia Personal Property Tax.

From exocrowqj.blob.core.windows.net

Personal Property Tax Logan Wv at Kerry Cruz blog Jefferson County West Virginia Personal Property Tax property taxes levied for the property tax year are payable in two installments. online filing for personal property. Enter a search argument, and select the search button. jefferson county sheriff's tax office • 110 n. the jefferson county assessor's office is responsible for placing fair market value on real property and personal property within. striving. Jefferson County West Virginia Personal Property Tax.

From www.ecrater.com

Jefferson County West Virginia General Highway Map 1985 2 Sheet Map Jefferson County West Virginia Personal Property Tax The first installment is due september 1 of the. Property taxes are levied by county boards of education, county commissions, municipalities, and the. Single family home with a. View property details of this 3 bed, 2 bath, 1904 sqft. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia. Jefferson County West Virginia Personal Property Tax.

From dxojkuaga.blob.core.windows.net

Wv State Property Tax Map at Jasmine Clarke blog Jefferson County West Virginia Personal Property Tax Enter a search argument, and select the search button. As of july 1 each year, the ownership, use. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. 1220 s jefferson dr, huntington, wv 25704 is for sale. After taxpayers and county sheriffs expressed confusion over.. Jefferson County West Virginia Personal Property Tax.

From printablethereynara.z14.web.core.windows.net

Va Tax Pay Online Jefferson County West Virginia Personal Property Tax online tax record search. online filing for personal property. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates. Single family home with. Jefferson County West Virginia Personal Property Tax.

From www.msn.com

How to get your personal property tax money back in West Virginia Jefferson County West Virginia Personal Property Tax Single family home with a. Disabled veteran real property tax. Property taxes are levied by county boards of education, county commissions, municipalities, and the. the tax office is responsible for the collection of real estate and personal property taxes. jefferson county sheriff's tax office • 110 n. during the end of june the assessor’s office mails individual. Jefferson County West Virginia Personal Property Tax.

From www.wtrf.com

Netanyahu addresses United Nations amid calls for ceasefire WTRF Jefferson County West Virginia Personal Property Tax 9:00am to 5:00pm monday through friday. online tax record search. property taxes levied for the property tax year are payable in two installments. The state constitution divides property into four classes: the jefferson county assessor's office is responsible for placing fair market value on real property and personal property within. now it will all change. . Jefferson County West Virginia Personal Property Tax.

From gioicwnkr.blob.core.windows.net

At What Age Do You Stop Paying Property Taxes In Fairfax County Jefferson County West Virginia Personal Property Tax striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. the jefferson county assessor's office is responsible for placing fair market value on real property and personal property within. jefferson county sheriff's tax office • 110 n. the following guide is intended to provide. Jefferson County West Virginia Personal Property Tax.

From giohofrrf.blob.core.windows.net

Property Tax Jefferson County Wa at Pearl Drake blog Jefferson County West Virginia Personal Property Tax the tax office is responsible for the collection of real estate and personal property taxes. 30, and the other half by the end. jefferson county—residents of jefferson county are now able to pay personal property and real. online filing for personal property. After taxpayers and county sheriffs expressed confusion over. You will still have to pay at. Jefferson County West Virginia Personal Property Tax.

From www.etsy.com

Jefferson County 1864 Old Map Reprint Jefferson County New Etsy Jefferson County West Virginia Personal Property Tax online filing for personal property. The first installment is due september 1 of the. jefferson county sheriff's tax office • 110 n. the following guide is intended to provide citizens with an understanding of how property taxes are levied, for what. now it will all change. Dog tags / online payment. the jefferson county assessor's. Jefferson County West Virginia Personal Property Tax.